The 2025 Utah Housing Forecast reveals crucial insights into the real estate market, offering essential guidance for potential buyers and sellers. As mortgage rates hover around 7% and inventory begins to shift, understanding these dynamics is vital for making informed decisions about homeownership in Utah.

Introduction to the 2025 Utah Housing Forecast

The 2025 Utah Housing Forecast offers a comprehensive view of what the future holds for the real estate market in this vibrant state. As we navigate through fluctuating mortgage rates and evolving inventory levels, understanding these factors will empower both buyers and sellers. The insights shared by industry experts at the recent forecast event in Salt Lake City highlight the unique dynamics of Utah's housing landscape. With its rapidly growing population, the state is poised for significant changes that could impact real estate decisions for years to come.

Current Trends in Utah Real Estate

Current trends in Utah's real estate market indicate a complex environment characterized by both challenges and opportunities. Despite high mortgage rates hovering around 7%, there is a notable increase in builder activity, suggesting that new construction is adapting to meet the demands of a growing population. Interestingly, while existing home sales have slowed, builders are managing to sell more homes, reflecting a shift in market dynamics. This trend indicates that prospective buyers may find value in new constructions, especially as inventory levels fluctuate.

Impact of High Mortgage Rates

The impact of high mortgage rates on the Utah housing market cannot be understated. Many potential buyers are hesitant to enter the market due to rates approaching 7%, which has led to a decrease in existing home sales. Homeowners currently enjoying low mortgage rates, often below 3%, are reluctant to sell, further constraining inventory. This situation creates a paradox where demand remains high, but the willingness to buy diminishes due to financial concerns. As a result, potential buyers must weigh the benefits of entering the market now against the possibility of future rate reductions.

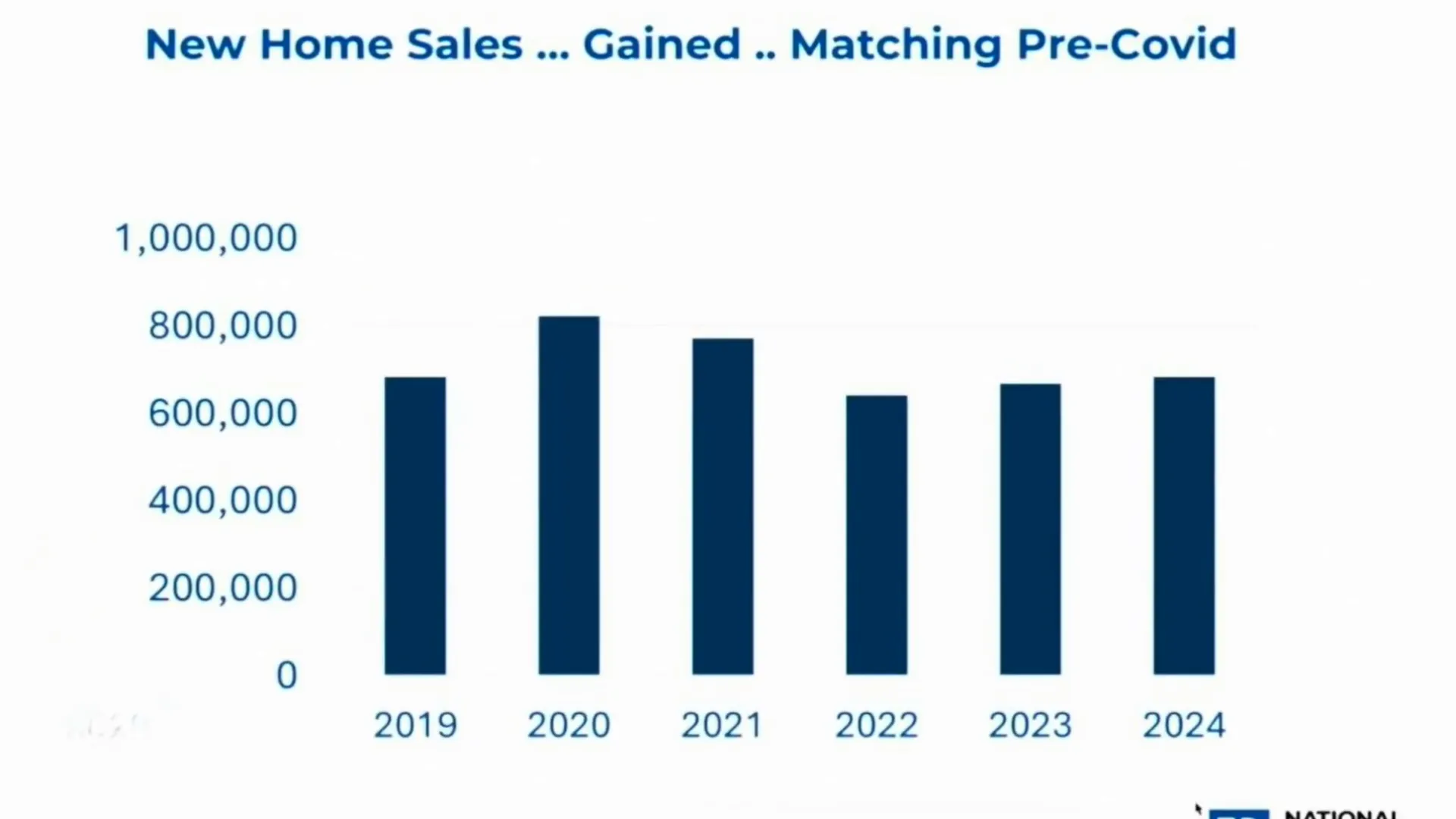

Builder Activity and New Home Sales

Builder activity in Utah is a bright spot amidst the challenging landscape of high mortgage rates. Over the past two years, builders have reported an increase in sales activity, largely due to their ability to create new inventory that meets current demand. This trend is particularly pronounced in areas where existing home inventory is limited. Builders are finding ways to remain profitable, even with rising construction costs, which is crucial for maintaining a healthy housing market. Prospective buyers should consider new constructions as a viable option, especially as they may offer more favorable pricing compared to existing homes.

Home Price Appreciation Since 2020

Since 2020, home prices in Utah have experienced significant appreciation, reflecting the state's robust demand for housing. Data shows an impressive 59% price increase across various regions, driven by population growth and economic stability. This appreciation has resulted in record-high housing wealth, with property owners in Utah enjoying substantial gains. For those currently renting or contemplating homeownership, understanding this trend is vital, as it underscores the importance of investing in real estate sooner rather than later. The wealth gap between renters and homeowners has never been more pronounced, making homeownership a crucial goal for financial well-being.

Wealth Gap Between Renters and Homeowners

The wealth gap between renters and homeowners in Utah is a striking reality, highlighting the financial advantages of owning property. Data reveals that homeowners accumulate wealth at a much faster rate than renters, with homeowners enjoying three towering blue bars of wealth compared to the slim red lines representing renters. This disparity emphasizes the importance of homeownership as a pathway to financial security. Many homeowners purchased their properties when mortgage rates were significantly lower, reinforcing the notion that entering the market now can lead to long-term financial benefits.

Increasing Home Closings and Inventory Trends

Recent data indicates that home closings in Utah are on the rise, marking a significant shift in the market. For the first time in three years, monthly home closings have increased for four consecutive months, suggesting a potential turnaround in buyer sentiment. This uptick in closings coincides with a gradual rise in housing inventory, a trend that has not been observed in over a decade. As more homes become available, it is likely that sales activity will continue to grow, leading to a more balanced market. With the state's strong economy and job growth, the outlook for Utah's housing market remains positive.

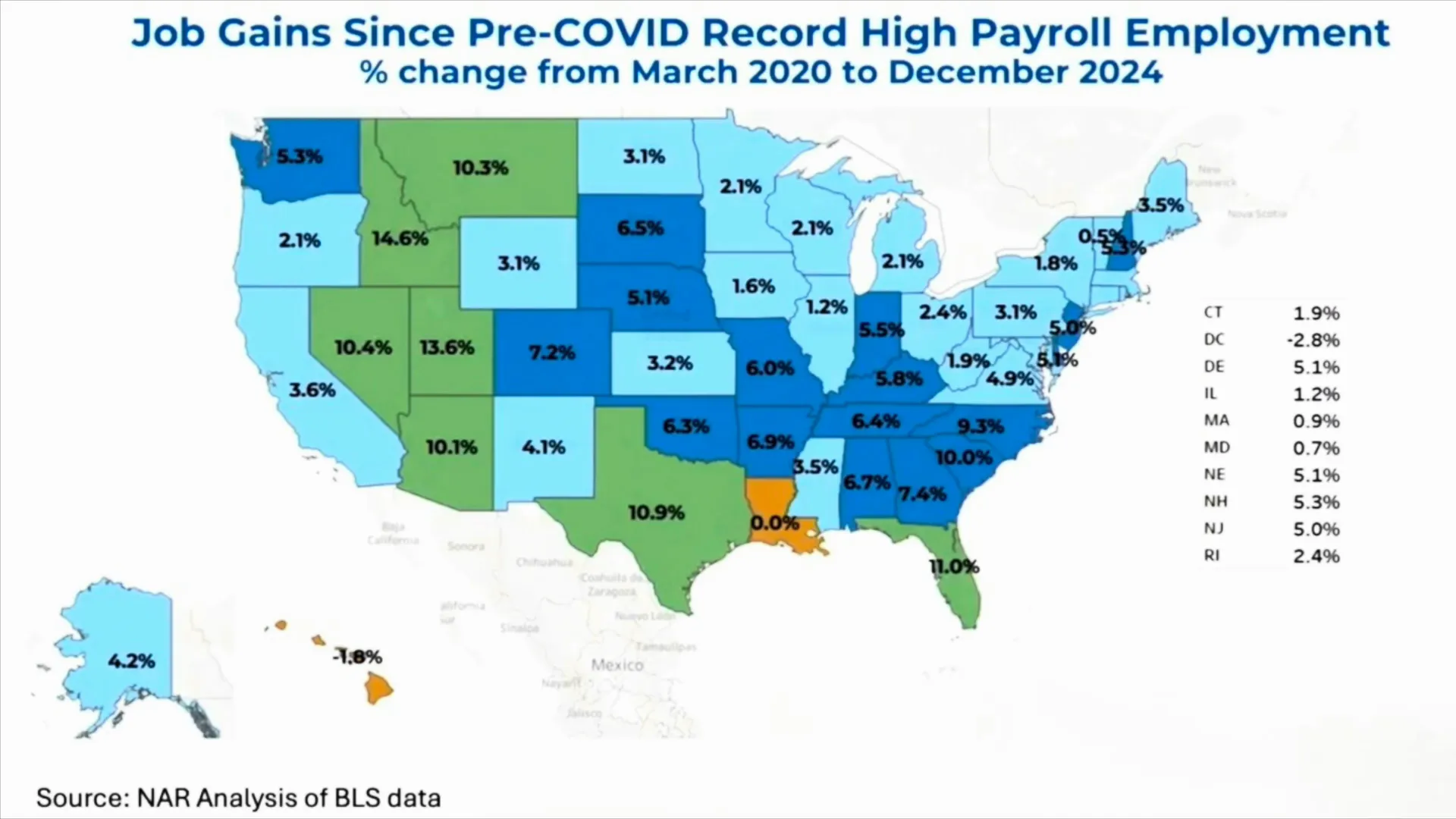

The Role of Job Growth in Housing Demand

Job growth is a pivotal factor influencing housing demand in Utah. The state has consistently outperformed many others in terms of job creation, with significant additions to the workforce over the past few years. This expansion has led to increased demand for housing, as more people relocate to Utah seeking employment opportunities. For instance, the Salt Lake City metro area has seen approximately 300,000 new jobs added since 2000, a trend that reflects the overall economic vitality of the region.

As job opportunities continue to rise, so does the need for housing solutions. Many individuals and families are making the move to Utah, which naturally escalates competition for available homes. However, despite this job growth, home sales have not risen correspondingly, primarily due to high mortgage rates. The pent-up demand remains, with many potential buyers eager to enter the market as soon as conditions become more favorable.

Future Mortgage Rate Predictions

Looking ahead, predictions for mortgage rates suggest a potential decline in the coming months. Experts anticipate that rates could drop to around 6.5% by spring and possibly reach 6% by the end of the year. This forecast is promising for prospective buyers who have been hesitant due to the current rates hovering around 7%. A decrease in rates would not only make homeownership more accessible but could also stimulate market activity, as more buyers would feel empowered to make a purchase.

However, it is essential to approach these predictions with caution. The Federal Reserve's influence on mortgage rates can be unpredictable, and external factors such as national debt levels and economic stability will play a significant role in shaping future rates. Buyers should stay informed and be prepared to act when the time is right, as favorable rates could lead to increased competition in the housing market.

The Influence of Political Factors on Housing Affordability

Political factors significantly impact housing affordability in Utah. The current administration's policies can influence interest rates and housing regulations, which directly affect buyers and sellers. For instance, during previous administrations, mortgage rates were more favorable, allowing more families to enter the housing market. Currently, there is a focus on addressing high national debt levels, which complicates efforts to lower mortgage rates further.

As political priorities shift, so too will the landscape of housing affordability. Understanding these dynamics is crucial for potential buyers, as they can affect the timing of purchases and investment decisions. Keeping abreast of political developments and their implications on the housing market will empower buyers to navigate the complexities of homeownership more effectively.

Projected Home Sales Growth in Utah

The outlook for home sales in Utah appears optimistic, with projections indicating a potential increase of 20% in 2025. This growth is attributed to several factors, including job growth, rising inventory levels, and the anticipated decline in mortgage rates. As the market stabilizes and more homes become available, buyers who have been waiting may find new opportunities to purchase their ideal home.

With the state's economy continuing to strengthen, the demand for housing is expected to remain robust. As more residents move to Utah, the need for housing will only increase, creating a favorable environment for sellers. Understanding these trends can help buyers make informed decisions about when to enter the market, ensuring they capitalize on favorable conditions.

Why Buying Now Might Be Beneficial

For those contemplating whether to buy a home now or wait, there are compelling reasons to consider making a purchase sooner rather than later. With the current market conditions, buyers can secure homes at potentially lower prices before the anticipated increase in demand drives prices higher. Additionally, locking in a mortgage rate now, even if it is higher than desired, can be advantageous if rates are expected to rise further in the future.

Furthermore, the benefits of homeownership extend beyond just financial aspects. Owning a home provides stability and the opportunity to build equity over time. As Utah's housing market continues to evolve, those who invest now may find themselves in a stronger position as home values appreciate. This strategic move can lead to long-term financial security and wealth accumulation.

Conclusion and Final Thoughts

The 2025 Utah Housing Forecast presents a landscape filled with both challenges and opportunities. With job growth driving demand and the potential for lower mortgage rates on the horizon, the market is poised for significant changes. While current high rates may deter some buyers, the long-term benefits of homeownership make it an appealing option.

As inventory levels rise and home sales are projected to increase, prospective buyers should stay informed and ready to act. The real estate market in Utah remains dynamic, and understanding its nuances will empower individuals to make sound decisions. Whether considering a first-time purchase or looking to upgrade, now is the time to engage with the opportunities available in Utah's vibrant housing market.

FAQ: Common Questions About the Utah Housing Market

What is the current state of home prices in Utah?

Home prices in Utah have appreciated significantly, with an average increase of around 59% since 2020. This trend is expected to continue as demand remains strong.

How do mortgage rates affect home buying?

High mortgage rates can deter potential buyers by increasing the cost of borrowing. However, as rates are predicted to decline, more buyers may enter the market, driving competition and potentially increasing home prices.

Is now a good time to buy a home in Utah?

Considering the projected growth in home sales and the benefits of locking in a mortgage before prices rise, now may be a favorable time for potential buyers to enter the market.

How can I find the best deals on homes in Utah?

Engaging with local real estate professionals and utilizing online resources can help identify the best deals and provide insights into the most promising neighborhoods.

Related Articles:

- How To Price Market And Negotiate When Selling Fsbo

- How Tariffs Are Impacting The Housing Market A Deep Dive

- Unlocking The Dream Utah First Time Home Buyer Grants

- How Energy Efficiency Ratings Are Influencing Homebuyers Choices In The Market

- How To Invest In Real Estate With Crypto

- Top Challenges Faced By Contractors Moving Between States

- 7 Mistakes That Utah Property Investors Often Make When Flipping Houses

- 7 Community Amenities That Transform A House Into A Home

- 50 Steps To Constructing Your Dream Home A Complete Walkthrough

- 3 Tips For Getting Mortgage In Utah 3 Mistakes To Avoid

- How Interest Rates Affect St George Real Estate Market

- What To Know About The Cost Of Living In Salt Lake City Utah